It’s Been a Decade of AI in the Drug Discovery Race. What’s Next?

ALSO: Why This Quantum Computing/Gen AI Company Stock Sank After Debut; $1.4 Billion for AI-Driven ADC Development; Unexpected Problem with AI in Pharma; Bayesian Approach to Target Discovery

Hi! I am Andrii Buvailo, and this is my weekly newsletter, ‘Where Tech Meets Bio,’ where I talk about technologies, breakthroughs, and great companies moving the biopharma industry forward.

If you've received it, then you either subscribed or someone forwarded it to you. If the latter is the case, subscribe by pressing this button:

This week’s sponsor: Trialize

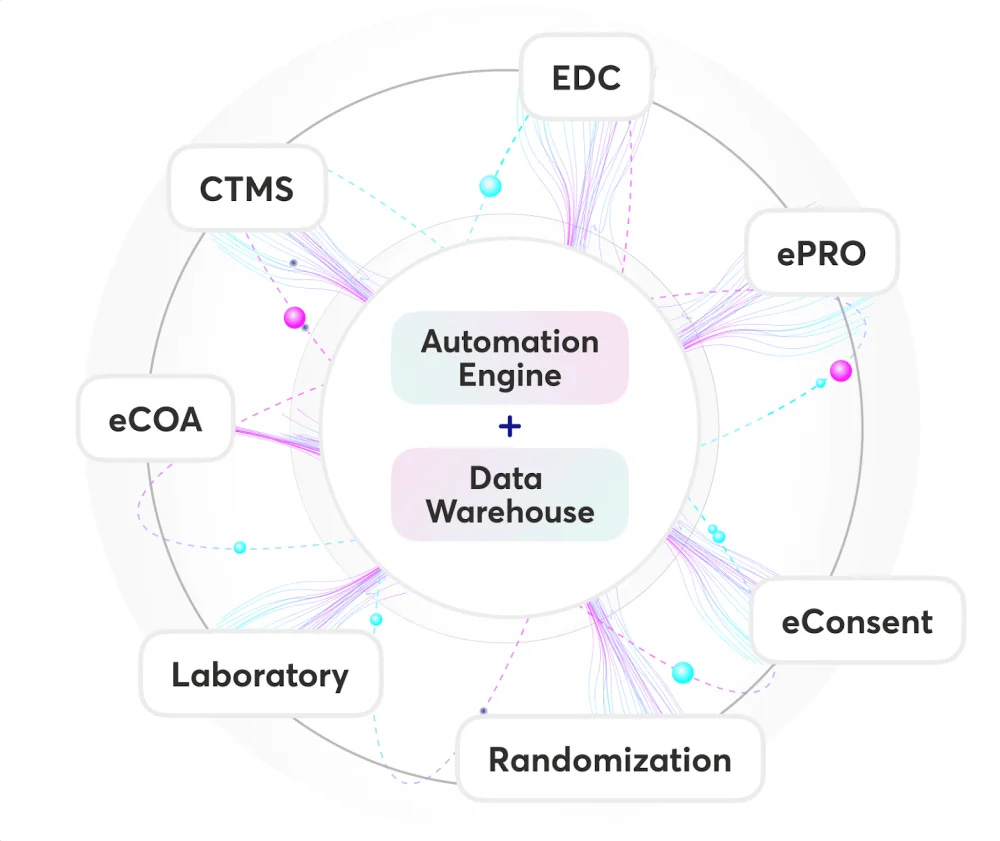

In the realm of clinical trials, efficient data management and monitoring are crucial yet often hampered by outdated and time-consuming practices.

Trialize's innovative approach to automating study builds and leveraging artificial intelligence (AI) for data analysis significantly reduced the time from protocol to trial, transforming the process from a traditionally months-long undertaking into a matter of days.

When inputting the study protocol, Trialize's AI analyses it to extract essential information, such as visit schedules, relevant forms, eCOA scales, and even drafts initial Informed Consent Forms (ICFs).

Trialize’s architecture offers a comprehensive, integrated solution covering all aspects of clinical trial management – from Electronic Data Capture (EDC) and Electronic Patient-Reported Outcomes (ePRO) to TeleVisits, eConsents, and Analytics. Its interface is designed to be intuitive and user-friendly, drastically reducing the learning curve for study teams.

Read Trialize’s case study Revolutionizing Clinical Trials: How AI and Automation Reduced Study Build Time from Months to Days, explaining the unique technical capacity of Trialize’s platform.

Now, let’s get to this week’s topics!

It’s Been a Decade of AI in the Drug Discovery Race. What’s Next?

I am excited to announce that BioPharmaTrend.com released a new study, called It’s Been a Decade of AI in the Drug Discovery Race. What’s Next?, which looks at the historical progress of AI in the pharma industry and the “apple-to-apple” comparison of 9 leading AI platforms.

A cool feature, I think, is that we tracked a historical progression of AI-designed drug candidates for the following companies: BenevolentAI, Exscientia, Insilico Medicine, insitro, Recursion, Relay Therapeutics, Schrödinger, Verge Genomics, and Valo Health.

It means, we found archived pipeline screenshots or company filing information and tracked each pipeline molecule from drug discovery all the way to where it is now (including setbacks and abandoned programs).

What it shows is the dynamics of how companies grew their programs from nothing to clinical pipelines. It is clear that the dynamics is way faster than ‘traditional’ companies, so AI seems to be helping accelerate the process.

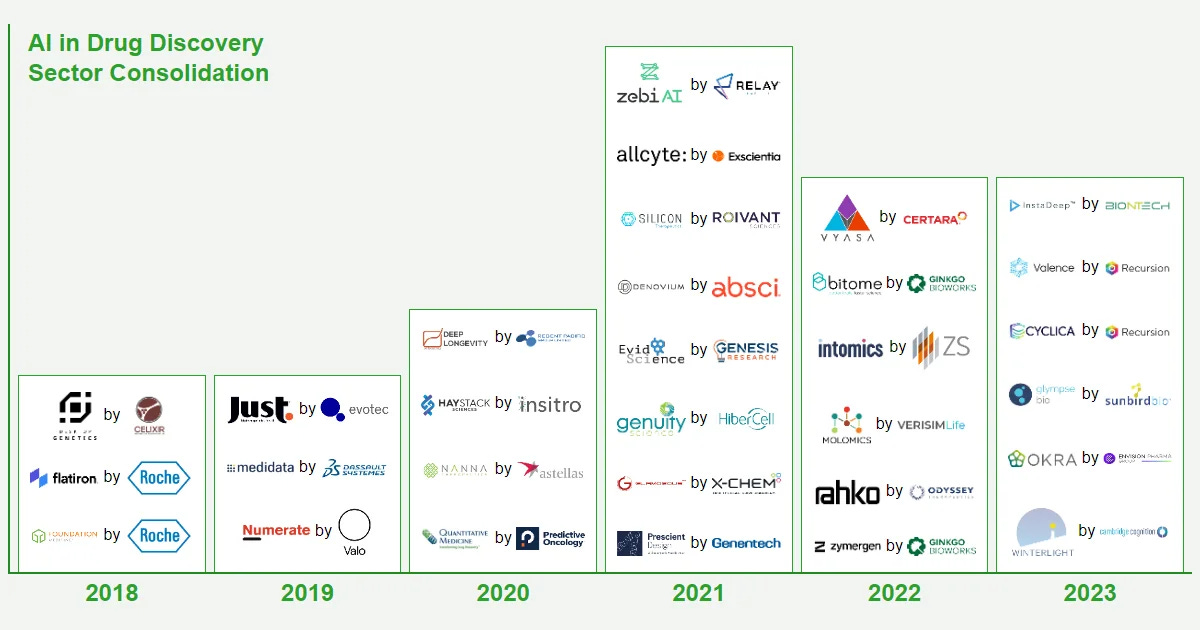

Along with some financial analysis of AI companies, the report includes an overview of key M&A deals in 2018–2023, highlighting more than 30 significant deals mapped year by year.

It is clear the AI sector is consolidating and the entry barrier for new AI startups is growing.

One of the reasons is that newcomers just don’t have enough proprietary data to really compete with established players.

Big Pharma is also shifting toward partnering with well-established AI platforms for large and more strategic deals, compared to typical pilot collaborations some 5-7 years ago.

There is also an increasing role for infrastructure providers such as NVIDIA, Google, and Microsoft. They are expanding into drug discovery and can even compete with drug companies directly. (Read one of my previous newsletters where we discussed NVIDIA microservices.).

The report features basic financial analysis and revenue trends for the leading AI platforms, for those who are into balance sheets and P&Ls.

I hope the report can be a decent reference point for discussing AI in drug discovery!

Below, I am copying one of the chapters:

AI in Drug Discovery Sector Keeps Consolidating

The AI in the drug discovery and development race has been going for more than a decade now, and today we see all signs of the sector’s consolidation.

Over the last 6 years, there have been more than 30 merger and acquisition events in this space.

According to the BiopharmaTrend report some of the AI-focused deals in drug discovery, biotech, and clinical trials space included:

2018 acquisition of Flatiron Health by Roche for $1.9 billion;

2019 acquisition of Numerate by Valo Health;

2020 acquisition of Haystack Biosciences by Insitro;

2021 acquisition of Prescient Design by Genentech;

2022 acquisition of Zymergen by Ginkgo Bioworks for $300 million;

2023 acquisition of InstaDeep by BioNtech for $549 million

double acquisition of Cyclica and Valence Labs by Recursion Pharmaceuticals for around $90 million combined, to name just a few.

Some of the notable deals are summarized in the figure below:

Another driver of consolidation is expansion of “big tech” giants into the life sciences, including NVIDIA, Alphabet, Microsoft and others. They leverage their cutting edge resources in artificial intelligence research, world-class tech infrastructures (software, cloud, computational power) and flexible business models.

Famous successes include Alphabet subsidiary DeepMind in protein modeling space, Isomorphic Labs’ recent partnerships with Eli Lilly and Novartis, the advent of NVIDIA’s AI-based Clara Discovery platform for everything from drug design to healthcare research, and Microsoft Cloud for life sciences.

As Dr. Alex Zhavoronkov writes in his Forbes article: “In 2024, I predict NVIDIA will come out big with its healthcare platform so that the need for new AI in drug discovery (AIDD) companies will go away. Drug discovery players will be able to use NVIDIA tools in their cloud, on Amazon, or on massive clusters of NVIDIA GPUs locally.

It is unlikely to hurt established AIDD players with end-to-end AIDD platforms and significant validation, but it will inhibit the formation of startups with little or now differentiation, and it will add more credibility to the field.”

Dr. Zhavoronkov continues about Microsoft: “In 2024, we should expect to see massive growth in LLMs in pharma and biotech, with Microsoft being the main provider. Even when some LLM startups achieve superior performance in benchmarks and come up with new models, they do not stand a chance in big pharma.

Pharma is very conservative; there are too many compliance and legal challenges to deploying generative AI from a new vendor. Microsoft made it easy to use the latest OpenAI models on Azure Cloud and to implement sophisticated AI platform architectures. And Microsoft works all over the world. I predict many internal-external LLM architectures will be built on the Microsoft platform”.

Next, according to the BiopharmaTrend report, venture capital firms are increasingly prioritizing smaller numbers of established AI in drug discovery players over new platform companies, which is a sign of consolidation.

Finally, ‘big pharma’ and leading biotech corporations are increasingly shifting from external partnerships towards building their own AI muscle, effectively diminishing opportunities for novel startups to win R&D dollars.

Big Pharma is increasingly choosing well-established technology vendors and validated AI for drug discovery engines.

The consolidation of AI in the drug discovery sector naturally led to the formation of a distinct group of AI frontrunners—companies that managed to build sufficient AI capabilities, robust business models, and win major clients. From Table 2 below, one can see that several companies, including Insilico Medicine, Recursion Pharmaceuticals, Schodinger, and XtalPi, demonstrate strong financials, compared to some of the peers in this space.

> > > read full report.