On Predicting Probability of Technical and Regulatory Success With AI

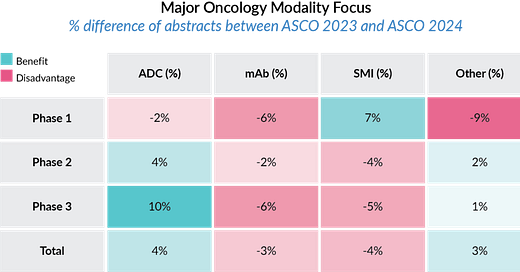

Insights from The American Society of Clinical Oncology (ASCO) Annual Meeting 2024

Hi! This is BiopharmaTrend’s weekly newsletter, ‘Where Tech Meets Bio,’ where we talk about technologies, breakthroughs, and great companies moving the biopharma and medtech industries forward.

If you've received it, then you either subscribed or someone forwarded it to you. If the latter is the case, subscribe by pressing this button: