Weekly Tech+Bio Highlights #11

ALSO: Hype vs Gold in AI Drug Discovery; Defining Intelligence and Consciousness; GSK, Flagship Partner for Drug Discovery; 12 Emerging Neurotech Startups to Watch in 2024; Milestone for stem cells.

Hi! I am Andrii Buvailo, and this is my weekly newsletter, ‘Where Tech Meets Bio,’ where I talk about technologies, breakthroughs, and great companies moving the biopharma and medtech industries forward.

If you've received it, then you either subscribed or someone forwarded it to you. If the latter is the case, subscribe by pressing this button:

Now, let’s get to this week’s topics!

Quick News Highlights

🔬 GSK and Flagship Pioneering partner to develop novel medicines and vaccines in respiratory and immunology, jointly funding up to $150 million initially, with potential milestones up to $720 million.

🧠 Synchron achieves the first use of Apple Vision Pro with an implantable brain-computer interface, enabling a patient with ALS to control the device hands-free and voice-free, showcasing a significant advancement for individuals with paralysis.

🎗️ Adaptimmune receives FDA accelerated approval for TECELRA (afamitresgene autoleucel), the first engineered cell therapy for solid tumors, specifically for advanced MAGE-A4+ synovial sarcoma in adults with certain HLA types who have undergone prior chemotherapy. This marks the first new treatment for synovial sarcoma in over a decade.

💰 VC firm venBio secures $528 million for its fifth fund to back about a dozen biotech startups over the next three years, following successful IPOs and M&A exits, including companies like Alumis, Artiva, and RayzeBio.

🔬 Asimov launches its AI-driven 4th generation CHO Edge System, guaranteeing titers of 5 g/L for IgG monoclonal antibodies as part of its Cell Line Development Service, with advanced optimizations for various biologic architectures and increased titer range of 5-11 g/L.

🔍 Paige open-source their foundational models PRISM and Virchow.

Virchow, the first million-slide AI model for cancer developed with Microsoft Research, and PRISM, a multi-modal model for cancer insights, are now available on Hugging Face to aid researchers and developers in cancer diagnosis and treatment.

📈 Venture capital investment in biopharma surged in Q2, with $7.6 billion raised across 107 investments, signaling industry growth. J.P. Morgan forecasts $28.2 billion in venture funding for 2024, driven by significant rounds like Xaira Therapeutics' $1 billion and Formation Bio's $372 million, alongside healthy M&A activity and an expanding IPO market.

🔬 Inoviv launches MasterKey, a customizable platform for multiplexed targeted protein assays, enabling researchers to select from a vast, pre-characterized database of thousands of proteins. Leveraging advanced mass spectrometry and the InoKey workflow, MasterKey ensures precision and reliability for therapeutic and clinical research.

💊 Rejuvenate Biomed and SAS partner to create an AI-driven, disease-agnostic drug repurposing discovery tool on SAS Viya, aimed at accelerating drug development for age-related diseases.

🚀 Harvard spinout GRO Biosciences raises $60 million in Series B financing to advance its ProGly-Uricase gout drug, designed to avoid immune response issues seen with Amgen's Krystexxa. The technology, using non-standard amino acids, aims to improve treatment efficacy for gout and potentially other autoimmune and inflammatory disorders.

🧬 23andMe's board rejects CEO Anne Wojcicki's plan to take the company private at 40 cents per share, valuing it at $230 million. The board requests changes and expects Wojcicki's support for a revised business plan to stabilize the company. Wojcicki owns nearly 110 million shares with significant voting power.

📝 Insilico Medicine unveils Science42:DORA, an AI-driven tool designed to streamline academic writing and research for scientists, especially early-career researchers and non-native English speakers. The platform leverages LLMs to assist in drafting scientific documents like papers, grant applications, and research summaries, aiming to improve efficiency and quality in scholarly output.

How to differentiate hype from substance in the AI drug discovery space?

A pretty cool take by Dr. Alex Zhavoronkov, co-founder and co-CEO of Insilico Medicine, published in Genetic Engineering & Biotechnology News.

Alex suggests to ask 10 simple but clear questions when evaluating AI drug discovery companies for the purpose of invstment or partnering:

✔ How many of your internally discovered drugs are in Phase I, Phase II, and Phase III?

✔ Did any of your pharma partnerships progress into Phase I, II, and III, and how long did it take?

✔ How many preclinical candidates (PCCs) did you nominate in a single year and in total?

✔ How long, on average, does it take you to nominate a PCC, and how much does it cost?

✔ What was the level of novelty of the targets and what is the level of novelty of the molecules?

✔ How long, on average, does it take you to go into clinical trials with an AI-discovered target?

✔ Did you in-license any of your drugs from other companies, repurpose them, or discover them internally?

✔ How many pharma companies use your AI software to discover drugs, and how many users do you have? How many renew every year?

✔ What was your revenue last year, and what was the revenue growth year over year?

✔ How much money have you raised, in how many rounds, and what is the valuation of your last round?

To me, this list is a conversation starter, more than it is a comprehensive guide. But it is important to ask these questions. What do you think? Write additional questions in the comments. You may want to check public discussion in my LinkedIn post here, there were a lot of interesting comments, additional criteria, and some criticism as well.

I have my thoughts on this, but it is a topic for another newsletter that is coming soon...

How to Define Intelligence and Consciousness for In Silico and Organoid-based Systems?

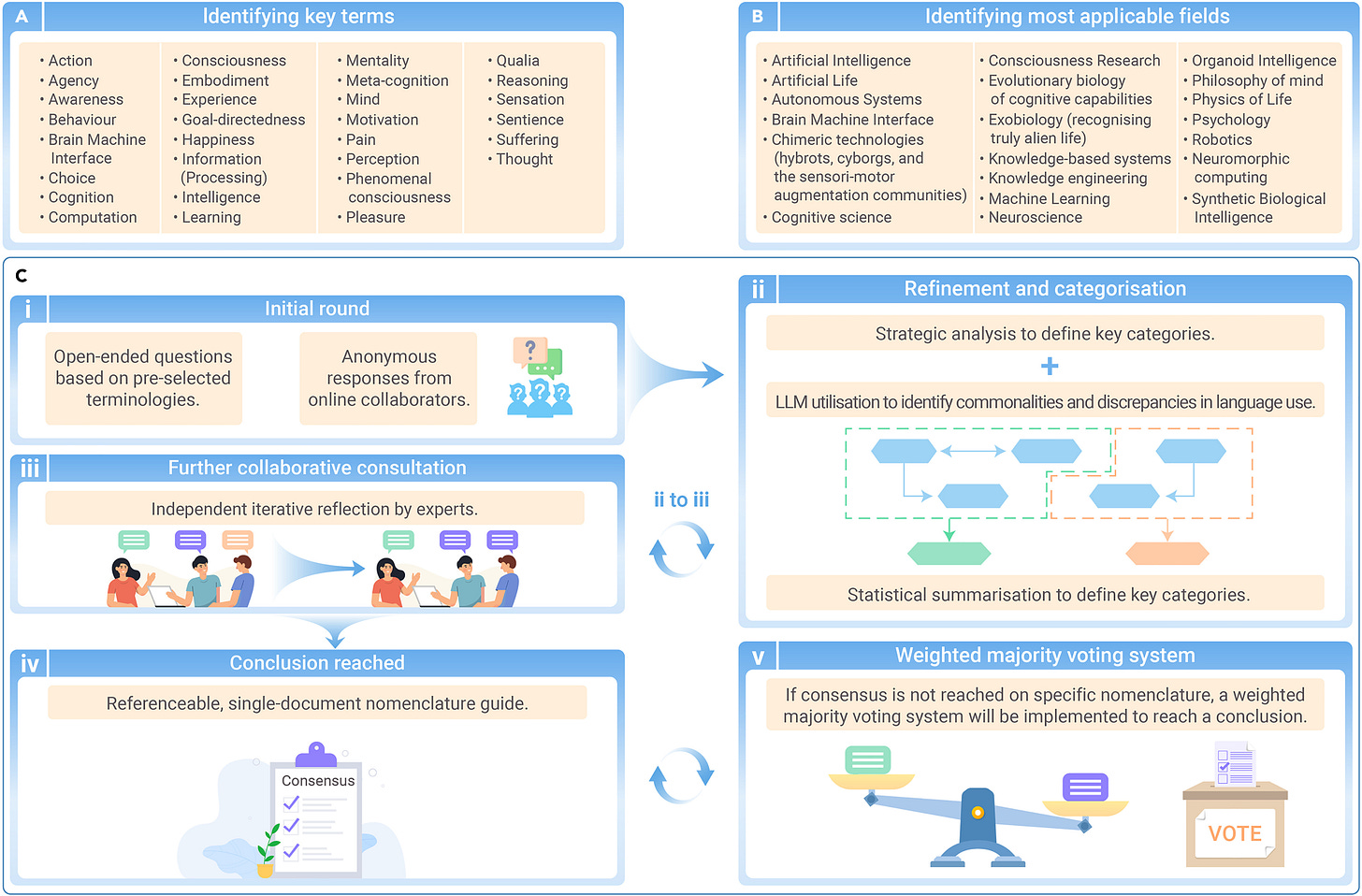

A global initiative is underway to create consensus definitions for diverse intelligent systems, including AI, LLMs, and biological intelligences.

Led by Cortical Labs, the biological computing startup known for "Dishbrain," this project brings together scientists, ethicists, and researchers from the UK, Canada, USA, EU, Australia, and Singapore. Their goal is to standardize the language in the rapidly advancing and often contentious field of generally intelligent systems.

The Need for Consensus

The field of intelligent systems encompasses a wide range of technologies and disciplines, each with its own terminology. Fifteen years ago, at least 71 distinct definitions of “intelligence” were identified. Today, the rapid growth of this field makes it impractical for researchers to redefine every ambiguous or imprecise term in each publication. A unified language is essential for the recognition, prediction, manipulation, and construction of cognitive (or pseudo-cognitive) systems, particularly those with unconventional embodiments that differ significantly from natural species.

Previous attempts to establish nomenclature guidelines have been highly specific to certain fields and developed by select experts, limiting broader community engagement. The current effort seeks to involve a wider range of stakeholders to develop a theory-agnostic standard that can be applied across multiple disciplines.

The Approach

The collaboration will define key terms applicable to various fields, such as artificial intelligence, autonomous systems, consciousness research, machine learning, organoid intelligence, and robotics (see figure above).

The initiative will use a mixed-method approach with a modified Delphi method, which involves several iterative rounds of consultation and refinement:

Initial Round: Pre-selected open-ended questions are posed.

Strategic Refinement and Categorization: Responses are analyzed and categorized.

Collaborative Consultation: Participants engage in iterative discussions to refine terms.

Achieving Consensus: If consensus is not reached, a weighted majority voting system will be used to finalize definitions.

This approach aims to create a critical field guide for researchers developing diverse intelligent systems, addressing the current lack of standardized terminology.

Collaboration and Participation

Cortical Labs' Chief Scientific Officer, Brett Kagan, emphasizes the importance of this collaborative effort:

“Ultimately, the purpose of this collaboration is to create a critical field guide for researchers across a broad range of fields who are engaged in the development of diverse generally intelligent systems. In what is a rapidly evolving space, such a guide doesn’t yet exist.”

Professor Ge Wang from RPI, USA, echoes this sentiment, highlighting the limitations of current approaches to multimodal multitask foundation models.

Researchers and scientists in related fields are invited to collaborate and contribute to this nomenclature effort, providing nuanced and consistent language for emerging technologies.

Interested collaborators can register at Cortical Labs Nomenclature.

GSK, Flagship Partner for Drug Discovery

As Alex Philippidis reported for Genetic Engineering and Biotechnology News, GlaxoSmithKline (GSK) has announced a significant partnership with Flagship Pioneering to develop up to 10 new drugs and vaccines, focusing initially on respiratory and immunology indications.

This collaboration could potentially generate more than $7 billion for Flagship and its portfolio companies, leveraging GSK's expertise and Flagship’s innovative ecosystem.

Key Takeaways

The partnership aims to develop up to 10 new drugs and vaccines.

Initial focus areas are respiratory and immunology indications.

The collaboration could generate over $7 billion for Flagship Pioneering and its portfolio companies.

GSK brings therapeutic expertise and development capabilities, while Flagship provides a robust ecosystem of 40 biotech companies.

Joint funding of up to $150 million will be provided upfront to identify and accelerate promising scientific concepts.

Flagship and its bioplatform companies could receive up to $720 million in payments tied to milestones, preclinical funding, and royalties.

GSK's respiratory/immunology pipeline includes treatments for severe asthma, COPD, lupus, inflammatory diseases, EGPA, HES, and connective tissue disorders.

GSK recently acquired Aiolos Bio to strengthen its asthma portfolio.

Flagship’s Innovation Supply Chain Partnership model aims to generate transformational medicines with pharma partners.

GSK joins other biopharma giants like Pfizer and Novo Nordisk in collaborating with Flagship.

Flagship’s portfolio includes companies like Repertoire Immune Medicines, Seres Therapeutics, and Sonata Therapeutics.

Flagship recently launched Abiologics, a developer of programmable medicines combining AI and high throughput chemical protein synthesis.

Flagship plans to deploy $3.6 billion in new capital to support the creation and development of about 25 new startups.

3D-priting mRNA Vaccines

Triastek and BioNTech have entered a research partnership and platform technology licence agreement to develop 3D-printed oral RNA therapeutics.

Triastek's expertise in designing innovative oral tablet structures with multiple-layer and multi-compartment designs will optimize RNA delivery across the gastrointestinal mucosa. The designs will minimize degradation in the gastrointestinal tract and ensure the therapeutics reach areas with the highest absorption potential.

Triastek will receive an upfront payment of $10 million, with additional development, regulatory, and commercial milestone payments potentially exceeding $1.2 billion, along with tiered royalties from future product sales.

Upcoming Event Highlight

Join me during the 11th Aging Research and Drug Discovery Meeting (ARDD 2024) on August 26-30 in Copenhagen, Denmark! This is apparently the world’s leading meeting with a focus on aging research.

The New Milestone for Regenerative Medicine

A novel allogeneic mesenchymal stem cell (MSC) therapy, MAG200, developed by Australian company Magellan Stem Cells, has demonstrated notable efficacy in a Phase I/II clinical trial for knee osteoarthritis.

The therapy utilizes MSCs derived from adipose tissue, avoiding autologous cell harvesting complexities and immune rejection issues associated with donor-derived cells.

In the trial, 75% of participants receiving MAG200 experienced statistically significant improvements in pain and joint function, with a sustained 58% pain reduction at 12 months, corroborated by MRI evidence of improved cartilage volume and quality.

These findings suggest that MAG200 not only provides symptomatic relief but also promotes cartilage regeneration, potentially altering the disease course of osteoarthritis.